News

How quickly will your category bounce back? Lessons for Marketers from COVID-19 Data

How Quickly Will Your Category Bounce Back? Lessons for Marketers from COVID-19 Data

Seven Categories Where COVID-19 is Most Likely to Have Long-Term Consequences for Marketers

In an earlier article, we noted how major societal and business changes usually happen over three phases (based on the Change Management Model by Kurt Lewin). The first phase, “Unfreezing,” is when the natural order of things is disrupted. People are uncomfortable as they have to adapt to a new environment. This leads to the second phase, which we have paraphrased as “Chaos.” In this phase, we have to find new ways to get things done, but still aren’t sure what will work. In the third phase, “Refreezing,” people settle into new behaviors, some of which may be fundamentally different than before.

This change model fits the Coronavirus pandemic perfectly. However, big questions remain: When will we move into the “Chaos” phase (or are we there already)? And, more importantly, how will behaviors refreeze? Clearly, the answer is different for various parts of the economy. Every business sector has been affected by COVID-19, positively or negatively, in some way. However, some industries may bounce back quickly, whereas others will experience a lasting, if not permanent, impact. To date, there has been a great deal published on the economic effects of COVID-19 on various industries, but little rigorous analysis on how the virus will affect marketing in the medium-to-long term. We undertook this exercise – based on multiple data points – to understand which categories will bounce back faster and which are likely to take longer to go through Chaos and Refreezing. This has important implications for marketers as they consider how to begin planning for 2021 and beyond – particularly in seven categories that will feel more long-term pain than most: Accessories, Hotels and Catering, Automotive, Luxury Goods, Furnishing and Appliances, Fitness/Sports, and Skincare/Makeup industries.

The RedSky COVID Marketing Index

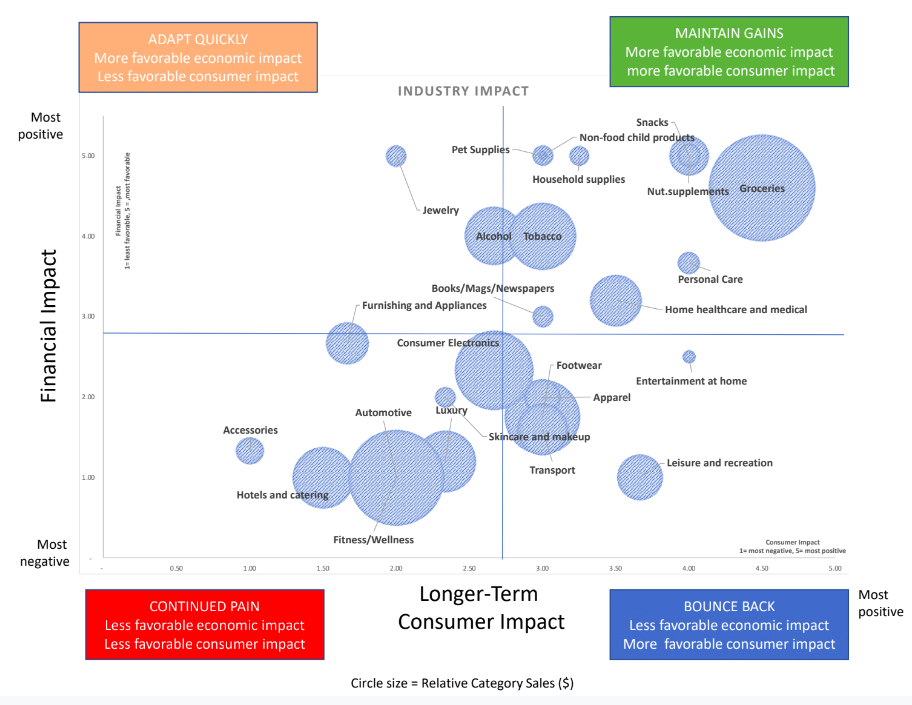

We wanted to understand which sectors might refreeze quickly without lasting impact, and which sectors will take longer to settle. To do this, we conducted a comprehensive COVID-19 impact analysis based on our proprietary research (see end of article for details of our study and the methodology used to construct the model) and the huge trove of publicly available financial and consumer data, including data from Asia, on how consumers behaved as COVID-19 was brought under control. This enabled us to build a robust model based on multiple data sources about a number of business sectors.The results are presented in the chart below.

The horizontal axis (Consumer Impact) shows the impact of COVID-19 on current and potential future purchasing habits. It seems to measure how much consumers have changed — and will continue to change — their shopping and spending behaviors. On the vertical axis (Economic Impact), we show the relative economic impact measured by changes in sales in the first few months of the pandemic. The sizes of the circles represent the industry size in 2019 dollars.

Let’s examine each quadrant at a high level and its implications.

Maintain Gains

It is clear that some industries have been less affected (or have even been favorably affected) by COVID-19 – both financially and from a consumer perspective. In these industries, buying habits didn’t fundamentally change (e.g., children’s products, household supplies) or they even improved in the short-term (e.g., groceries, nutritional supplements).

- It will be up to marketers in these categories to maintain consumer interest over time. Otherwise, their gains will be short-lived. As the old restaurant adage goes, “customers come first for the food, but come back for the service.”

- e-Commerce companies like Chewy that saw a strong boost in sales will need to act quickly to provide a great customer experience so that they retain these new customers and maintain their market share. In our research, we found that while Chewy attracted a significant number of new online customers, Amazon attracted a greater share of newly online pet parent shoppers.

However:

- Marketers in these sectors should not rest on their laurels. The pandemic may have unforeseen longer-lasting negative consequences. Marketers should undertake at least some rudimentary scenario planning given the enormous societal changes happening. For example, purchases of non-food baby items were fairly robust as parents sought to entertain their kids at home. However, experts predict that the economic impact of the virus will lead to approximately half a million fewer babies born next year. That’s half a million fewer customers next year. This demographic blip will have repercussions for a generation as this cohort ages.

- One problem that can come from sudden growth is misunderstanding where it came from. It’s extremely important to understand. Who are your new consumers? Why are they buying? What are they buying from you? It’s a good time for Marketers in this quadrant to develop (or revisit) a market segmentation to cement this understanding and operationalize it for the rest of their company.

Bounce Back

In the bottom right quadrant, we see sectors that took a “hit” financially but consumer trends point to a faster return to a type of ‘normal’. These categories are likely to bounce back relatively quickly or see shifts in buying patterns to more online purchasing. A good example is apparel and footwear. People reduced their clothing purchases dramatically in the spring, but this is likely to come back to some degree as stores open and people get out more. However:

- Even as these sectors start to rebound, don’t expect consumers’ behaviors to be the same in the short term. In our research, we found that only 21% of people feel comfortable clothing shopping in a store again. Inditex, the parent company of Zara, recently announced it will close 1,200 stores and invest $3 billion in e-Commerce. Successful marketers in this quadrant will need to change quickly if they want to emerge on solid footing and capture share.

- Tastes have also likely changed: companies may be more open to have people dress more casually (although sweatpants may not make it back into the office). Astute marketers will have their finger on the pulse of these changes and track influencers and fast-moving trends. Many of these marketers in this sector have already begun adapting, and are already undertaking new research studies to understand the changes. It’s important to ensure that this research is fast and practical – providing takeaways you can use right away.

Adapt Quickly

The few categories in the top left saw less negative financial impact, but may continue to see weakness or major changes in consumer purchasing patterns. Furniture is a good example. Companies like Wayfair saw strong gains in online furniture shopping, but consumers may put off large purchases as they try to save money, and new housing starts are down compared to last year. Jewelry companies also saw some strong sales but this strength was not evenly distributed across the industry

- Companies in this quadrant will also need to adapt quickly, as consumers’ decisions and shopping habits are likely to change here, too. NPD reports that at the beginning of the crisis, people immediately sought out appliances for healthy living. Air filters, water filters, and so on, saw triple digit increases in sales. Additionally, appliance retailers report that shoppers are now much more concerned about reliability and longevity since they are using their appliances more and are wary of having repair service technicians in their homes.

- People are doing more of their shopping online than ever, even for categories they used to only shop in-person (e.g., used cars, jewelry, mattresses). When consumers buy that new couch or refrigerator, they may not tour showrooms and instead opt to buy online and return it if necessary. Industries in this quadrant need to take a hard look at their costs – even “fixed” ones – in order to adapt.

- Marketers here will need to assess how to allocate (and to reallocate) resources based on the going-forward market attractiveness vs. margin, but do so in a rigorous, methodical way. They should not be afraid to jettison categories or product lines that are not delivering on margin or growth expectations. Our FISH model provides a rigorous approach to just such resource allocation questions.

Continued Pain

Industries in the bottom left quadrant were hit financially and are also likely to face long-term difficulties as consumers shift their spending elsewhere or avoid the sector. Reduced demand at the category level – not just supply shocks, channel shifts or supply chain issues – are signs of longer-term trouble for consumer goods. These industries are; Accessories, Hotels and Catering, Automotive, Luxury Goods, Jewelry, Fitness/Sports, and Skincare/Makeup. As an example, Moody’s predicts that the automotive sector will not recover at least until 2022!

We will dive more deeply into the seven sectors in this quadrant in a follow-up article, but it is safe to say that their economics have and will fundamentally change. We can expect total upheaval in their marketing and even bankruptcies for those who fail to move quickly.

- The need to adapt is paramount: For companies in this quadrant that can adapt quickly, they may be able to emerge with new business models and ways of doing business that can lead to long-term success. It won’t be easy. Marketers in these sectors will face long-term pain as they struggle to regain a solid footing, while cutting costs. Nevertheless, we have seen some brilliant innovation even in the hardest hit sectors such as gym/fitness companies transitioning to omni-channel services and moving to become more lifestyle brands

- Protect your current customers at all costs: now, more than ever, companies in this group need to understand their current customers and do whatever it takes to retain them. When things get back to some semblance of normal, these customers will be the first to return.

- Innovate now: It will be important for companies in this sector to be able to pivot quickly, if necessary moving into potential areas of growth. We have seen this with many restaurants as they move into the home delivery business. But these companies will not be able to do things as they have always done. Taking a gourmet seven course meal and stuffing it into seven styrofoam containers isn’t the experience that one looks for in an elegant meal – just as online browsing doesn’t replace the hands-on guidance of Sephora’s make-up artists. Now is the right time to invest in a full innovation exploratory to create a different, but unique and ownable experience in the new world.

In the coming weeks, we will look at these most-affected industries and understand what they are doing — and should be doing — to recover.

Whatever sector your company is in, the message is clear: this is no time to be complacent. Marketers that take the time to understand their consumers today, and look to the near and long-term future will be more prepared to adapt and thrive.

Methodology

RedSky Strategy Proprietary Research: These findings are from the new national survey that ran three times from March 30 through June 5 in order to better understand the impact of the COVID-19 pandemic. The survey results were comprised of a representative sample of the US population, including approximately equal amounts of women and men, spanning ages 18-65+. The survey aimed at uncovering people’s attitudes both during and about the pandemic by asking questions around self-assessed mental and physical health, consumer behaviors, attitudes, and more.

Marketing Impact Index: To calculate the MII, we used a number of sources (see below). We used the data to sort each industry into a particular quintile, and then averaged the quintiles to obtain the final relative scores for each industry. Some of these studies looked at examples from China and Korea to understand spending patterns as cities ended lockdowns.

The main sources used were:

- RedSky Strategy COVID tracker (proprietary research among 1080 people across 3 waves from March-June)

- EY Future Consumer Index (April 2020)

- VerticalIQ Sector analysis

- Deloitte State of the Consumer Report (various dates)

- Moody’s Global Global Covid Impact Heatmap

- US Census Bureau Survey of Small Business

- GWIWebindex Coronavirus Research (Wave 4 May 2020)

- McKinsey & Company Research (various reports on general industry trends, beauty),

- Kantar Research

- Business Insider

- Luth Research

- National Retail Federation

Other sources include:

- www.cosmeticsdesign.com coronavirus impact research

- Reportlinker Jewelry Report