News

Netflix 4k UHD: Unknown Upgrade or Unexpected Price Hike?

Image Credit: https://unsplash.com/photos/jtmwD4i4v1U

More platforms providing streaming services has created an increasingly competitive environment, leading to streaming wars filled with pricing pressures. For Netflix, this has led to them testing price hikes in different markets.

Traditionally, much of Netflix’s popularity stemmed from its “access all areas” policy, giving users access to everything available on its servers under a single monthly subscription plan. However, as the streaming giant introduces pricing increases for higher quality content, most recently its UHD/4K content, it could end up alienating a fair share of its user base and cause them to question and reconsider what drew them to the service in the first place.

Netflix is the only major streaming service that charges an extra $4.50 for 4k resolution. However, it does not advertise this upgrade. Why would they leave so much money on the table when almost all new TVs sold are 4k and most streaming subscribers have high-speed internet?

The answer is a multi-faceted one.

A Past of Pricing Changes

A perceived price hike may hurt some of Netflix’s brand value, especially with a past riddled with poorly messaged pricing changes in the past.

Netflix’s 2011 price hike, for example, led to a loss of 800,000 subscribers. The company quickly backtracked and offered its DVD rental service at a lower price. But the damage was done – many subscribers had already decided to cancel their memberships.

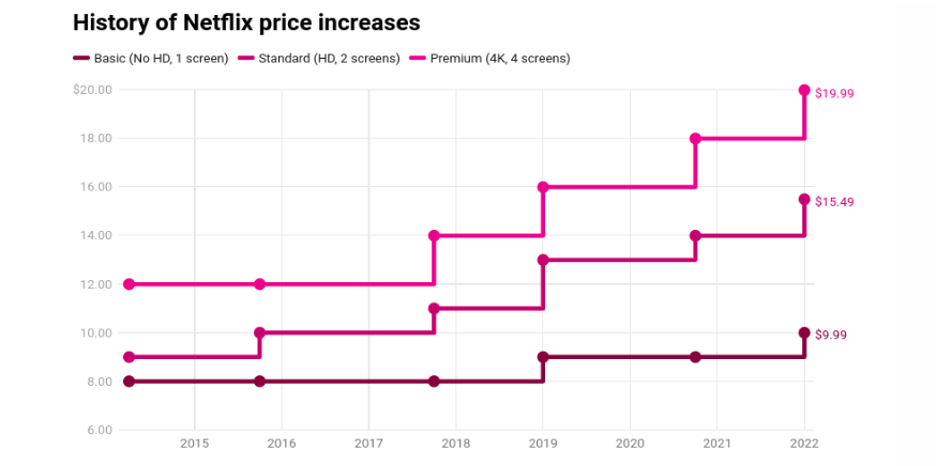

In 2014, it unrolled its first wide-scale price increase, going from $13 to $14 per month for a standard plan (they let existing members retain their original plan pricing for two years). Since then, prices have continued to increase every couple of years, with the basic plan now costing $9.99 per month, the standard plan $15.49, and the premium plan (which includes HD and Ultra HD) $19.99.

Netflix most recently raised eyebrows when it upped its monthly pricing for higher resolution streaming – so much so that it caused Netflix stock (NFLX) to collapse. Following the announcement of the price increase, shares of Netflix dropped over 35% in 24 hours, and it lost a significant amount of subscribers for the first time in over a decade.

The drop in shares caused the streaming platform to lose over $50 billion from its market cap. Currently, it’s the worst-performing stock of the year in the S&P 500, marking a nearly 63% year-to-date drop.

Cracking Down On Password Sharing

Among the price increases are a handful of factors influencing the platform’s market growth. Additional considerations include an increasingly competitive and crowded environment and loosening of pandemic restrictions. During COVID-19 lockdowns, streaming services benefited from more people staying home and using the TV and movie platforms.

As quarantine mandates have relaxed, the streaming services market has seen a slower household broadband growth. Currently, Netflix estimates approximately 100 million households share account passwords with other family and friends.

Netflix’s war on password sharing has also eroded the value of a subscription. The streaming platform has been forced to find new strategies to crack down on password sharing in an effort to promote growth.

In addition to proposing a lower-priced tier that includes ads, Netflix’s reaction to this was to begin producing its own content. It invested nearly 6 billion dollars in 2018 on original programming, more than any other US streaming network (and some TV networks, such as CBS and AMC. The catalyst for this investment was the hope to see a decline in the number of people sharing passwords and an increase in the number of paid subscribers.

Following the release of Netflix’s 2022 shares update, a Bank of America analyst explained that the firm was one of nine Wall Street companies to downgrade Netflix in its shares report, indicating the doubt and fear surrounding Netflix’s long-term growth potential. Despite the streaming platform’s plans to limit password sharing and introduce an ad model, they don’t believe this will make or show any discernible difference until 2024.

The Future of 4K

In addition to the potential to lose even more subscribers for cost-related reasons, there are other possible reasons why Netflix may not currently be jumping at the opportunity to advertise its 4k plan. 4k broadcasts require about five times as much bandwidth as HD. That’s a lot more data that Netflix has to push through its servers and out to your TV. Second, there’s not a ton of 4k content available yet. So while it might be a nice option to have, it’s not essential.

Netflix probably doesn’t want to anger its HD users by shoving 4k down their throats (and wallets). Perhaps it also doesn’t want to overwhelm its servers and risk service outages.

If Netflix did advertise the 4k upgrade, millions of loyal subscribers would likely upgrade, each providing an additional $4.50 monthly high-margin revenue. But, how many would abandon the service if they thought their Netflix subscription already included 4k? They would likely view this as an unwanted price hike to get a benefit they may already think they have.

There’s also the issue of an increasingly crowded market. None of the other major services charge for higher quality streaming services, with even basic plans including 4k support (Hulu $6.99 per month, HBO Max $14.99, Disney+ $7.99 per month, and Apple TV+ $4.99).

Netflix is currently in a strong position with nearly 222 million paid subscribers worldwide. However, the company faces challenges that could jeopardize its success in the future. This includes:

- Increasing competition from other streaming services such as Amazon Prime, Hulu, and Disney+, as well as new competitors such as Peacock and Paramount+ investing in original content

- High cost of producing original content

- A history of poorly executed pricing changes that could come back to haunt them

Despite these challenges, Netflix has a strong brand and is currently the leading streaming service in the world. Only time will tell if it can maintain its position atop the streaming industry.

Netflix’s decision to charge more for 4K resolution may be a smart one. By gradually introducing the price hike in select markets, Netflix can test the waters and see how subscribers react before implementing it on a larger scale. If the price hike is well-received, then Netflix can roll it out globally. However, if there is a negative reaction, then Netflix can adjust its strategy accordingly.

To make such critical business and pricing decisions, it’s important for brands to understand the personal point of video of the different kinds of audiences. This means considering not just what the reaction is, but what the different reactions from various audience segments will be. There’s also a need to understand the impact on a strong but faltering brand .

Interested in working with RedSky Strategy? We can help you leverage HumanSight, segmentation, and concept testing to illuminate the past path toward growth for your brand.